POWER SUPPLY

JOBS & TECHNOLOGY

ISSUE: September 2009

|

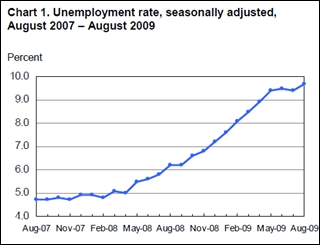

Weathering the Economic Storm: How are Power Electronics Engineers Doing? Unemployment in the U.S. has been rising steadily rising since the spring of 2008. According to a recent announcement by the U.S. Department of Labor’s (DOL) Bureau of Labor Statistics, despite some moderation in job losses in recent months, the ranks of unemployed in the U.S. has continued to rise. In August, the national unemployment rate hit 9.7% (Figure 1). Naturally, that number doesn’t bode well for electrical engineers, but are EEs faring better or worse than the rest of the workforce? And what about EEs specializing in power electronics? Those questions are tough to answer without conducting some focused research. However, there is quite a bit of data to suggest how different manufacturing sectors are faring. That data is worth considering because those sectors have traditionally employed many engineers responsible for the design of power supplies and motor controls. The data also provides a backdrop for some anecdotal evidence of what’s happening on the power electronics employment scene.

Figure 1. U.S. unemployment data courtesy of the U.S. Dept of Labor’s Bureau of Labor Statistics. Manufacturing is Down, But Some Sectors Fare Better Than Others The recent announcement by the USDOL’s Bureau of Labor Statistics stating that “manufacturing employment [in August] continued to trend downward, with a decline of 63,000,” but offered some encouragement noting, “The pace of job loss has slowed throughout manufacturing in recent months.” That figure of 63,000 represents the number of jobs lost from July 2009 to August 2009. It relates not only to individuals working in factories, but to all employees of companies classified as manufacturers. One month doesn’t paint much of picture, so if we go back a year, we see that U.S. manufacturers employed 13,387,000 in August of 2008, and that number fell to 11,771,000 in August of 2009. That’s a drop of 12%. To put that in perspective, the employment figures for the general civilian population fell from 145,273,000 in August 2008 to 139,649,000 in August 2009, which is a decrease of 3.9%. So it would seem that employment among manufacturers has fallen much more quickly in the last year, than U.S. employment in general. But what about the trends in specific segments of manufacturing that have strong ties to electrical engineering and power electronics? The Bureau of Labor Statistics provides quite a bit of data on employment in different manufacturing segments. If you want to study the data closely, I suggest visiting http://www.bls.gov/CES/ . (CES stands for “current employment statistics.”) To collect and organize their data, the Bureau of Labor Statistics uses a series of codes to classify different categories and subcategories within the manufacturing sector. These codes are defined under the North American Industry Classification System (NAICS) and you can look up codes and their definitions at http://www.census.gov/eos/www/naics/. I picked out a few manufacturing categories that I think are particularly relevant: Computers and Electronic Products Manufacturing (NAICS code 334), Electrical Equipment, Appliance, and Component Manufacturing (NAICS code 335) and Transportation Equipment Manufacturing (NAICS code 336). Then, I looked at some of the manufacturing sectors that fall within these broad categories. For example, under Computers and Electronic Products Manufacturing, you’ll find subcategories for manufacturers of Computer and Peripheral Equipment (NAICS 3341), Communications Equipment (3342), Audio and Video Equipment (3343) and Semiconductor and Other Electronic Components (3344). There’s employment data for all these subcategories and you can even go another level down. Reading lists of categories is mind numbing, so I’ll draw a family tree of sorts (in tabular form) to show what categories and subcategories within manufacturing I looked at: Table 1. Family Tree of Manufacturing Sectors Where Many EEs Are Employed—A Sampling of Categories and Subcategories.

So how are these segments faring in terms of employment? Since August of last year, employment among U.S. manufacturers of Computers and Electronic Products has fallen 10%, employment among manufacturers of Electrical Equipment, Appliance, and Components has fallen 12.6%, and among makers of Transportation Equipment has fallen 17%. These double-digit decreases sound ominous, but there is variation in how different subcategories under these categories have fared, as charted in the following table: Table 2. Decreases in Employment for Equipment Manufacturers in Select Categories and Subcategories from August 2008 to August 2009*

*Some figures reflect changes from July of ‘08 to July of ‘09. This sampling of data illustrates how employment prospects can vary a great deal within different segments of manufacturing. This data doesn’t tell us outright how EEs in the U.S. are faring in these specific industries, but the trends suggest there’s probably more stability in designing hardware for communications equipment or electronic instrument manufacturers than for computer makers or designing chips for semiconductor manufacturers. Similarly, U.S. engineers working at car companies may have less stability right now than those working for aerospace manufacturers. This is just a sampling. You may want to consult http://www.bls.gov/CES/ to find data on a specific industry that interests you. Besides looking at the one year employment data, it may be meaningful to look at longer term trends in employment. I have collected and graphed some of the data provided by Bureau of Labor Statistics to depict the employment trends for select categories and subcategories from January 2005 through August 2009. (See U.S. Employment Trends in Select Manufacturing Segments.) Beyond Manufacturing Data, What Do We Hear? To get a more direct sense of what the job market is like for power electronics specialists, I posed a series of questions to Bryan Rogers, owner of Elite Professional Solutions, a search firm specializing in the power management semiconductor and power electronics industries. When asked about the current strength of the U.S. job market for electrical engineers specializing in power electronics, Rogers said the market continues to be weak, despite “a noticeable uptick in hiring over the last 60 days.” I was specifically interested in how power electronics specialists are faring versus the general community of electrical engineers. When asked whether the market is better or worse for those in power electronics, Rogers said “it is impossible to say because hiring levels are so low that the data is skewed.” However, he expressed some optimism about future prospects saying, “As we move back toward a more normal job market, I believe that power electronics engineers will be back in higher demand than the average EE.” Suspecting that the U.S. government’s stimulus spending might be a factor, I asked Rogers whether he thought the stimulus was having an impact on the power electronics job market. “I don’t see it having any noticeable direct impact, said Rogers. “[But] to the extent that the stimulus spending improves overall economic activity, with resultant trickle down to employers, it will have a positive impact. “ What about the current efforts to invest in renewable energies? “There is some redirection on the part of legacy suppliers in the power electronics industry toward renewable applications such as inverters, micro-inverters and smart controllers. Right now I would say that the overall employment numbers are still low in those areas, but it is certainly a growth area,” said Rogers. I was also curious to know what other issues were influencing the prospects for power electronics specialists. This led to some comments about shortages of engineers. Rogers explained “The lack of electrical engineering graduates who are U.S. Citizens is a continuing challenge for employers who must decide whether to sponsor a foreign citizen for a H-1 Visa, or outsource a function or position. I believe that electrical engineering is still a great field for college students to study.” When asked about changes in the skills required of power electronics specialists, Rogers discussed the impact of digital power control. “The trend toward the use of digital controls in power conversion, motor controls and other traditionally analog applications is ongoing. So there are increasing needs for digital designers and software engineers with knowledge of power applications.” Acquiring digital design skills is just one way for an engineer to become more marketable. “It’s always about supply and demand, said Roger. “ By becoming a recognized expert in a segment of the power electronics field, an engineer can distinguish themselves from the rest of the pack. Job stability is also a key for job seekers. A candidate with too many job changes on their resume will rarely be invited to interview.” So while the current market for EEs focused on power electronics may be challenging for those currently seeking positions, long-term prospects should be much more positive. Now is certainly a good time to prepare for the next upswing in engineering opportunities by strengthening specialized skills of value in emerging applications involving digital power and renewable energy. And maintaining an awareness of trends in manufacturing employment may help engineers to assess whether the local industries where they might apply their skills are prospering. |